How to Set Up a Startup Data Room for Fundraising

A startup data room is an organized, secure digital repository where founders share key documents with investors during fundraising rounds. This guide walks you through setting up a professional data room, with a complete checklist organized by category and tips for making your due diligence process faster.

What Is a Startup Data Room?

A startup data room is a secure online space where founders store and share documents with potential investors during fundraising. Think of it as a digital filing cabinet that only approved people can access.

During due diligence, investors review your company's financials, legal structure, team background, and product details. Instead of emailing dozens of PDFs back and forth, you give investors controlled access to a single organized repository.

The term "virtual data room" (VDR) comes from M&A transactions, where deal rooms held physical documents. Today, startups use cloud-based data rooms with encryption, access controls, and activity tracking. Series A rounds typically require 30-50 documents, so having a system to organize them saves hours of back-and-forth.

When Should You Create a Data Room?

Build your data room before you start fundraising, not during it.

Investors expect to see materials within 24-48 hours of expressing interest. If you're scrambling to find your certificate of incorporation or last year's financials, you look unprepared. Well-organized data rooms correlate with 25% faster closes, according to industry benchmarks.

For seed funding, you might get away with a shared folder. But by Series A, investors spend an average of 118 hours reviewing data rooms. A professional setup shows you take the process seriously.

Create your data room when:

- You're 2-3 months from starting your fundraise

- You have a term sheet and need to prepare for due diligence

- You're maintaining investor relationships and want materials ready for opportunistic conversations

Complete Startup Data Room Checklist

Here's what to include in your data room, organized by category. Not every startup needs every document, but this covers what most investors expect to see.

Legal Documents

- Certificate of Incorporation and all amendments

- Bylaws (current version)

- Cap table (fully diluted, showing all option grants)

- Stockholder agreements and voting agreements

- Previous financing documents (SAFEs, convertible notes, prior round docs)

- IP assignment agreements from founders and employees

- Material contracts (customer agreements over $50K, vendor contracts, partnerships)

- Employment agreements for key executives

- Option plan documents and board approval

Financial Documents

- Last 3 years of P&L statements (or since founding)

- Current balance sheet

- Cash flow statements

- Monthly burn rate and runway calculations

- Financial projections for 3-5 years with assumptions

- Bank statements (last 3-6 months)

- Outstanding debt or loan agreements

Team Documents

- Org chart

- Founder bios and LinkedIn profiles

- Key employee bios

- Compensation summary for leadership

- Advisory agreements

- Employee handbook (if you have one)

Product and Metrics

- Product roadmap

- Key metrics dashboard (MRR, ARR, churn, CAC, LTV)

- Customer list (names may be redacted for early conversations)

- Case studies or customer testimonials

- Competitive analysis

- Technical architecture overview (high-level)

How to Organize Your Data Room

Structure matters more than aesthetics. Investors review hundreds of data rooms. Make yours easy to navigate.

Use clear folder names. Create top-level folders for each category: Legal, Financial, Team, Product, Corporate. Avoid clever naming. "Financials" beats "The Money Stuff."

Name files consistently. Include dates and versions. 2026-Q1-Financial-Statements.pdf is better than financials_final_v3_FINAL.pdf. When you update a document, don't delete the old version. Add a new file with the updated date.

Create an index document. Put a README or index file at the root that explains what's in each folder and when documents were last updated. This helps investors find what they need quickly.

Layer by sensitivity. Some documents can be shared with any interested investor. Others, like your detailed customer list or compensation data, should only be visible after a term sheet. Most data room tools let you set folder-level permissions.

Keep it current. Outdated documents raise red flags. If your last financial statement is from 8 months ago, investors will wonder what you're hiding. Update key documents monthly during an active fundraise.

Choosing a Data Room Platform

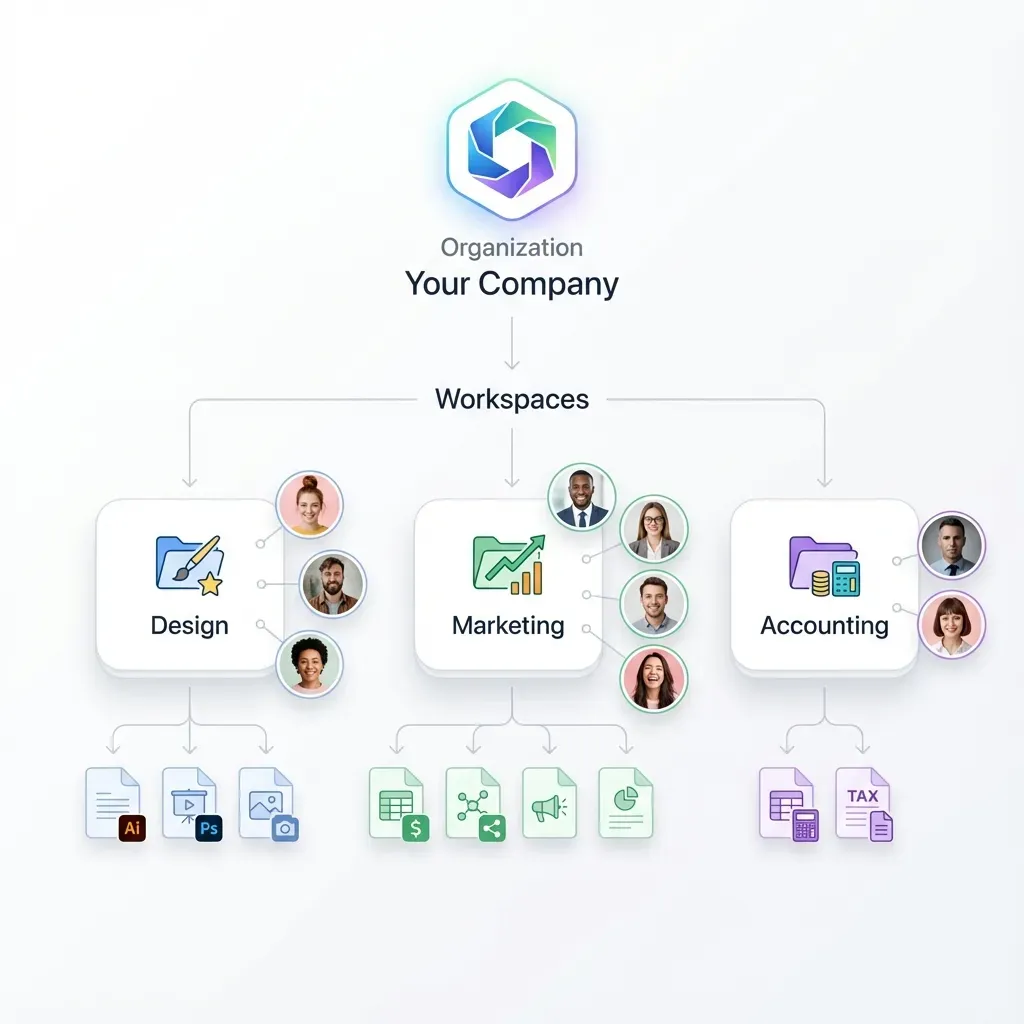

You have three main options: enterprise VDR providers, startup-focused platforms, and general file sharing tools.

Enterprise VDRs like Intralinks and Datasite are built for M&A transactions. They're expensive, often $15,000+ per deal, and overkill for most startup fundraises. The interface is usually dated.

Startup-focused platforms are built specifically for fundraising. They're simpler and cheaper but may lack advanced features like granular watermarking or detailed analytics.

General file sharing tools like Fast.io offer data room capabilities without the VDR price tag. Look for these features:

- Granular permissions - Control who can access which folders

- View tracking - See which investors opened what documents and for how long

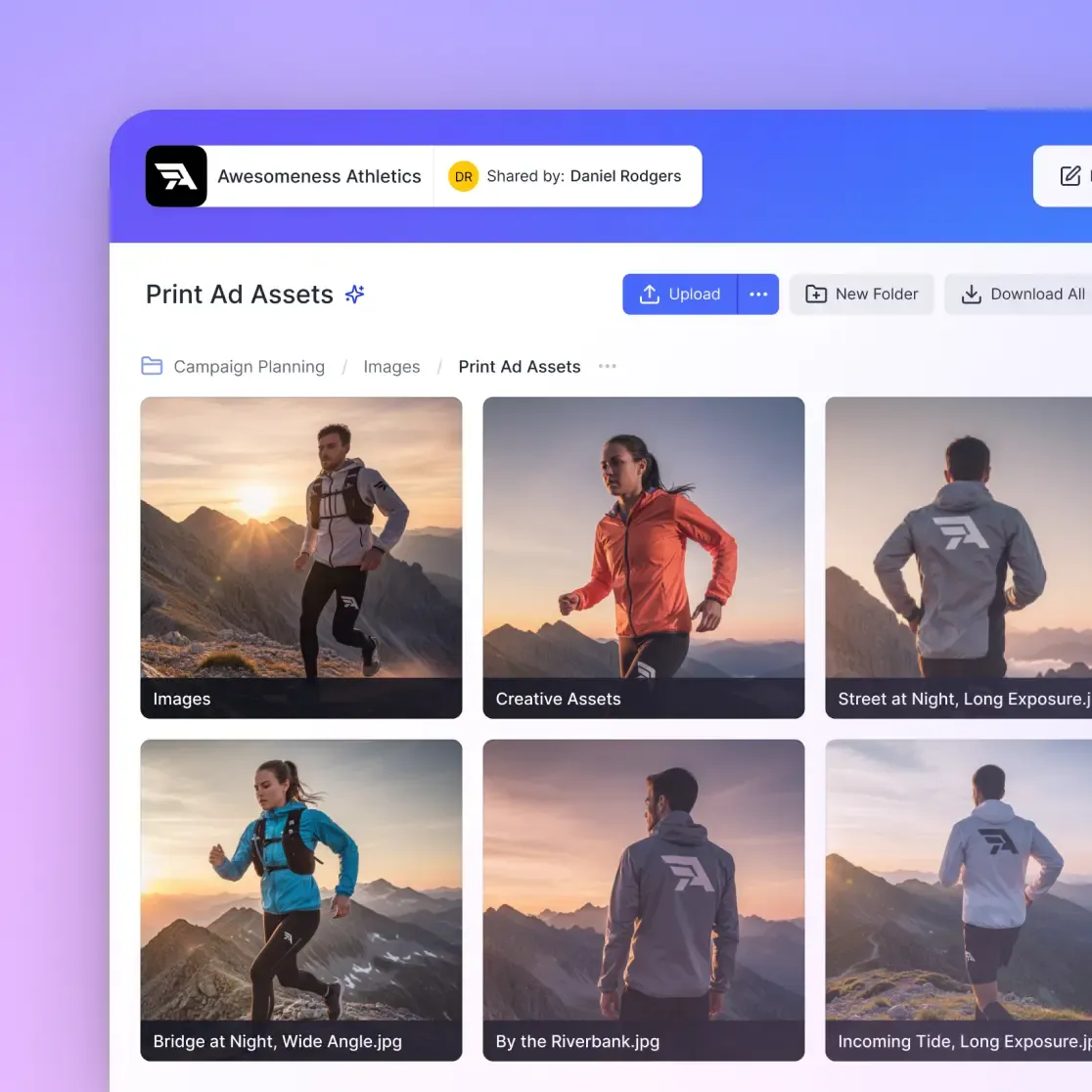

- Branded portals - Present a professional, white-labeled experience

- One-click revoke - Instantly cut off access when a deal falls through

- Audit logs - Track every view, download, and permission change

For early-stage startups, enterprise VDR pricing doesn't make sense. You can get the security features investors expect without spending $15K per round.

Data Room Security Best Practices

Investors expect your data room to be secure. Here's how to protect your sensitive documents.

Use link controls. Set expiration dates on shared links. Require passwords for access. Restrict downloads on sensitive documents so investors can view but not save local copies.

Enable watermarking. Dynamic watermarks that show the viewer's email address discourage unauthorized sharing. If a document leaks, you'll know who shared it.

Limit access by email domain. If you're sharing with a specific VC firm, restrict access to only @firmname.com email addresses. This prevents forwarding to unauthorized parties.

Review access regularly. When an investor passes on your round, revoke their access immediately. There's no reason for them to keep viewing your materials.

Track everything. Use audit logs to see who accessed what and when. If a document gets shared without permission, you'll have a trail. Activity tracking also gives you signal on investor interest. An investor who spent 3 hours in your financials folder is more serious than one who glanced at your pitch deck.

One note on compliance: unless you're in a regulated industry, you probably don't need a platform with SOC 2 or HIPAA certification. Focus on practical security features like encryption, access controls, and audit trails.

Common Mistakes to Avoid

After helping hundreds of startups with their data rooms, these are the mistakes we see most often.

Waiting until the last minute. Building a data room under deadline pressure leads to sloppy organization and missing documents. Start 2-3 months before you plan to fundraise.

Including too much. Investors don't need every document you've ever created. A focused data room with 30-50 key documents beats a cluttered one with 200 files. If investors want something specific, they'll ask.

Forgetting to update. Stale documents kill deals. If your "current" P&L is from two quarters ago, investors will question your attention to detail.

Ignoring mobile access. Partners often review data rooms on their phones or tablets. Make sure your platform works well on mobile devices.

Over-engineering permissions. Two access tiers work well: pre-term-sheet and post-term-sheet. More than that creates confusion and slows down your process.

Not tracking engagement. If you can't see which investors are actively reviewing your materials, you're flying blind. Engagement data helps you prioritize follow-ups and identify serious buyers.

What Investors Look for in Your Data Room

Understanding investor psychology helps you structure a better data room.

Consistency. Do your numbers match across documents? If your pitch deck says $2M ARR but your financials show $1.8M, that's a red flag. Before sharing, audit your documents for conflicting data.

Transparency. Investors know startups have problems. They're looking for founders who acknowledge issues rather than hide them. If you lost a major customer or have a legal dispute, include documentation. Trying to hide it only makes things worse when it surfaces later.

Organization. A messy data room suggests a messy company. If you can't organize documents, how will you manage operations at scale?

Completeness. Missing standard documents slow down diligence and create doubt. If your cap table is "being updated" or your financials are "coming soon," investors move on to the next deal.

Professionalism. Branded portals, clean file names, and a clear index show you've done this before. Or at least prepared like someone who has.

Frequently Asked Questions

What should be in a startup data room?

A startup data room should include legal documents (incorporation, cap table, previous financing), financial documents (P&L, balance sheet, projections), team information (org chart, bios, employment agreements), and product materials (roadmap, metrics, customer information). Series A rounds typically require 30-50 documents.

When should a startup create a data room?

Create your data room 2-3 months before you start fundraising. Investors expect materials within 24-48 hours of expressing interest, so being prepared signals professionalism. Well-organized data rooms correlate with 25% faster closes.

Do I need a data room for seed funding?

For very early seed rounds, a simple shared folder may suffice. But even at the seed stage, having organized documents impresses investors and prepares you for future rounds. By Series A, a professional data room is expected.

How do I organize a startup data room?

Create clear top-level folders (Legal, Financial, Team, Product, Corporate), use consistent file naming with dates, include an index document at the root, and layer permissions by sensitivity. Keep documents current and remove outdated versions.

How much does a startup data room cost?

Prices range widely. Enterprise VDR providers like Intralinks charge $15,000+ per deal. Startup-focused platforms typically cost $50-500 per month. General file sharing tools with data room features offer the most cost-effective option for early-stage startups.

What security features should a data room have?

Essential security features include encryption, granular folder permissions, password-protected links, view tracking, audit logs, and the ability to revoke access instantly. Dynamic watermarking and domain restrictions add extra protection for sensitive documents.

Related Resources

Ready to set up your data room?

Create a secure, investor-ready data room in minutes. Control access, track engagement, and close your round faster.